Unwarranted Fees for Private Mortgage Insurance Can Cost Borrowers THOUSANDS

In today’s market, it is not uncommon to find unbelievable deals on essentially brand new homes. However, financing these homes do not come without potentially unwarranted fees. If a purchaser is approaching the closing table with less than a 20% down payment and a credit score above 680 (or 10% down and stellar credit) to qualify for a conventional/conforming loan, they will most likely incur upfront and monthly fees for Private Mortgage Insurance ("PMI") through FHA financing regardless of how far below the "purchase price" (or “Offer”) is from the actual "market value" (or “appraised value”) of the home. (See HUD Glossary[1] for definitions).

Private Mortgage Insurance

PMI is an insurance policy that ensures the lender can “recover costs associated with the resale of foreclosed property, and accrued interest payments or fixed costs, such as taxes or insurance policies, paid prior to resale”[2] if a borrower defaults on a mortgage loan. The policy essentially covers the difference between the borrower’s down payment and the 20% equity requirement for a conventional/conforming loan allowing the FHA loan to be sold as a mortgage backed security to either Fannie Mae or Freddie Mac (freeing up capital for the lender to make more loans).

There are two types of PMI; first is an “upfront” fee that is paid at closing, and second is the monthly premiums that are added to the mortgage payment. The premium for PMI insurance is currently assessed at 1% of the loan amount upfront and up to an annualized 1.15% of the outstanding loan balance paid as a monthly premium added into the mortgage payment.[3] Assuming the purchaser does not sell the home and does not refinance, the borrower will pay the monthly PMI premium until 1) the borrower has paid down the principal on the loan to 20% of the original purchase price, or 2) 22% equity is reached based on the original appraised value of the home at the time of purchase. Although I will not get into the history of PMI or the “funny math” used to bypass upfront PMI with “piggyback loans” in the pre-crisis bubble run-up, I will devote an entire future blog to the issue on request.

Financing the Home

Let us assume, for the sake of argument here, that a purchaser does not have (or prefers not to provide) the requisites necessary for a conventional/conforming loan and the particulars of their loan qualifies them for FHA financing only (and triggers mandatory PMI).

Mortgage lenders will happily tell you that after 12 months of ownership (or vesting) a homeowner can refinance a loan to eliminate the monthly premium for PMI based on the appraised value of the home at the time of refinancing. While homes were gaining value in the pre-bubble days, this did lead to many homeowners doing just that. And although refinancing does eliminate the monthly payment, it does not trigger a refund of the upfront premium (a law passed by Bush in 2004[4] eliminated upfront PMI refunds [which, at the time, were 2% of the total loan amount]). At the current rate of 1% for upfront PMI, a loan for a home with a purchase price of $200,000 with a minimum 3.5% down payment is equivalent to $1,930. The calculation to arrive at the upfront premium of $1,930 is determined by the purchase price minus the down payment multiplied by the 1% upfront premium, as applied below:

$200,000 (Purchase Price)

- $7,000 (3.5% Minimum Required Down Payment)

= $193,000 (Loan Amount)

X 0.01 (1% Upfront PMI)

= $1,930 (Upfront PMI Fee)

The monthly premium paid in addition to the upfront amount for a $200,000 home is $186.81, as calculated below:

$193,000 (Loan Amount)

+ $1,930 (1% Upfront PMI)

= $194,930 (Total Loan Amount)

X 1.15% (Annualized PMI Percentage)

= $2,241.70 (Annualized PMI Payment)

÷ 12 (Months)

= $186.81 (Monthly PMI Payment)

In today’s market, where home values have yet to reach bottom, the likelihood of homeowners being able to escape the monthly premium by refinancing has greatly diminished – unless, of course, a potential homeowner contracted to purchase a home for far below its market value (i.e., a foreclosure, short sale, estate sale, or from an extremely motivated seller). With mortgage rates at, or near, historic lows, being able to refinance 12 months after possession of the home runs into the potential risk of an increased interest rate or decreased property value.

The Law as it Applies to PMI

Arguably, a homeowner (or potential homeowner) who took great care in selecting a discounted property should not be subject to either PMI assessment (upfront or monthly) if the home provides the 22% equity in and of itself at the time of purchase to eliminate PMI as explained by the Federal Reserve:

If your down payment is less than 20% of the value of the house, the lender will usually require mortgage insurance. The insurance policy covers the lender's losses if you do not make the loan payments. Typically, you will pay a PMI monthly along with each month's mortgage payment. Your PMI can be canceled at your request, in writing, when you reach 20% equity in your home (based on your original purchase price) if your mortgage payments are current and you have a good payment history. By federal law your PMI payments will automatically stop when you acquire 22% equity in your home (based on the original appraised value of the house) as long as your mortgage payments are current.[5] (Emphasis added).

The Federal Reserve states that PMI effectively must be removed automatically once 22% equity is reached based upon the appraised value at the time of purchase. For instance, if the home from the scenario above that was purchased for $200,000 with a down payment of $7,000 for a total loan amount of $193,000 and has a market/appraised value of $250,000, effectively 22.8% equity is reached the moment the purchaser puts pen to paper to sign the closing documents. The purpose of PMI is to ensure the lender can adequately recover in the event of a default on the loan securing the property. “Once the consumer’s loan balance falls within the 80 percent LTV[6] ratio, PMI is no longer needed. Excessive PMI coverage provides little extra protection for a lender and does not benefit the borrower.”[7] In today’s market, it is not uncommon to find homes deeply discounted below its “market value” (explained in more detail further below). And it is not uncommon to find foreclosed homes marketed by Fannie Mae or Freddie Mac that are even advertised as “no PMI” offered homes. However, mortgage brokers can shoot the notion that discounted, foreclosed homes can be obtained without PMI assessments by applying the United States Code (“U.S.C.”), which states that PMI termination date applies when:

(18) Termination date

The term “termination date” means —

(A) with respect to a fixed rate mortgage, the date on which the principal balance of the mortgage, based solely on the initial amortization schedule for that mortgage, and irrespective of the outstanding balance for that mortgage on that date, is first scheduled to reach 78 percent of the original value of the property securing the loan; and

(B) with respect to an adjustable rate mortgage, the date on which the principal balance of the mortgage, based solely on the amortization schedule then in effect for that mortgage, and irrespective of the outstanding balance for that mortgage on that date, is first scheduled to reach 78 percent of the original value of the property securing the loan.

12 U.S.C. §4901[8]

The USC defines “original value” to mean:

(12) Original value

The term “original value”, with respect to a residential mortgage transaction, means the lesser of the sales price of the property securing the mortgage, as reflected in the contract, or the appraised value at the time at which the subject residential mortgage transaction was consummated. In the case of a residential mortgage transaction for refinancing the principal residence of the mortgagor, such term means only the appraised value relied upon by the mortgagee to approve the refinance transaction.

Id.

When a mortgage lender/broker demands PMI payments based on the above definitions and terms, it places the advantage to the lender to require an insurance payment to guaranty repayment of the loan when the value of the asset provides the security in and of itself. In most cases, the PMI payments assessed against the homeowner will not drop off until after five years or when the remaining balance on the loan reaches 80% percent (at the consumer’s request) -whichever is longer. This mandatory PMI over a period of five years can cost a homeowner $13,138.50 using the $200,000 example above ($2,241.70 [annualized PMI premium] X 5 [years] + $1,930 [upfront PMI premium] = $13,138.50) regardless of whether the homeowner pays down the loan sooner to reach equity at a much earlier date. Homeowners unaware that they must request PMI assessments to cease once 20% equity is reached can incur additional fees during the time in which it takes to reach the automatic termination date based on the 22% equity trigger. Simply stated, lender PMI assessments are not being based on the underlying asset (per se), but on the ability of the purchaser to make the monthly payments (which is in direct opposition to the underlying premise of the law). However, that being said, credence is placed on the second part of the equation of eliminating PMI when 22% equity has been reached based on the appraised value of the home at either the time of closing or any time thereafter.

Eliminating PMI

Per federal law, there are three ways of eliminating monthly PMI payments: 1) paying down the loan until the amortization reaches 20% equity based solely on the original loan amount; 2) refinancing when the underlying asset has appreciated in value to provide 20% equity based on the then current appraisal; or 3) simply reappraisal of the asset. The first option would take the longest at approximately 7 to 15 years.[9] The second option eliminates monthly PMI payments much quicker in that a homeowner can use the appraised valuation of the property after 12 months vesting. Lastly, when simply reappraising the property the borrower still has to meet a 5-year payment history and be current on mortgage payments to successfully petition his or her lender for elimination of the monthly payments, although the lender is not obligated to oblige.[10] Again, I will not get into all of the particulars regarding PMI in this blog, but will devote an entire section to that issue upon request.

With the monthly PMI payments in this scenario tacking on an additional $186.81 a month, there is a huge incentive to refinance as soon as possible since it is the quickest means to eliminate unwarranted PMI payments. A typical refinance will cost in the neighborhood of 1% of the loan amount in lender’s origination fees, another $450 for an appraisal, and then various incidentals for points, attorneys fees, recordation, etc. (roughly $4,500+) Although, arguably, simply reappraising the property and requesting removal of PMI based on the new appraised value would be the most cost efficient, there is still the 5-year payment history hurdle using that avenue. All of which brings us directly to the appraisal.

Assessing the Market

Before venturing into refinancing as an option for removal of PMI, take particularly close assessment of the current value of your home. The easiest way to do this is to look at what non-distressed homes have sold for in the previous six-months within close proximity of your home that are of similar construction, size, and quality. As an example, if your home is a single-family split-foyer detached home with 3 bedrooms, 2 baths, 4-sided brick, built on a poured concrete foundation with a 2 car garage - look for homes with the same characteristics to get a better assessment of your home’s current value. Using the 5 bedroom, 4.5 bath, 3 story, 4 car garage, marble sided mansion that sold for $2.5 million 5 miles away is only going to cause you indigestion when you have over assessed the value of your home and have incurred expenses for an appraisal that yields a current value $180,000 because of unrealistic expectations. And do not accept an appraisal that compares your home to the 2-sided plank, 3 bedroom, 2 bath, townhouse with no garage either! Apples to apples, oranges to oranges. The homes do not have to be identical, but they do have to be fundamentally similar.

The best place to research the current sales prices in an area is a multi-listing service (MLS) (which is typically provided free of charge by realtor associations). Although Zillow, RealtyTrac, and similar sites (some paid, some free) do offer fundamentally important information, they usually are way off in the current assessed value of homes in that their information is not up-to-date and does not report conditions of homes or concessions offered by the seller. As an example, say the $200,000 home above was purchased at auction and a fundamentally similar home next-door sold on the open market for $300,000, Zillow will report that the current market value of your home is $200,000 and the house next-door will be equally diminished. Zillow does not take into account that the purchase price was based on an auction offering and reports property value as its sale price only (and typically takes months to update sales in an area until those sales are nearly a year old and are no longer useful in a current value assessment for your research). Zillow also reports foreclosures that “sold to the bank on the courthouse steps” as a sale, although no true sale took place. RealtyTrac is even worse – and it is a pay site (which, in my opinion, makes it an even more unrespectable source). Again, the best site for the most current up-to-date source for market information is your local MLS service (typically offered for free and updated by realtors in your area in “true time” [meaning within days of a sale]).

Value of the Home

When refinancing your home, the appraisal will have to be ordered by your lender, regardless. Unfortunately, we cannot choose our appraiser or the terms in which the appraisal is ordered (and the terms can be willy-nilly depending on the request of the lender). However, let it be known that an appraiser is supposed to be impartial and there to assess the home based on its own merits. To save yourself some heartache, again, be knowledgeable of the current market. If similar homes in your neighborhood are selling for $200,000 (the original purchase price), do not expect an appraisal to come in at $250,000. That being said, if similar homes are selling for $250,000, do not accept an appraisal for $150,000 simply because your home was once a foreclosed property.

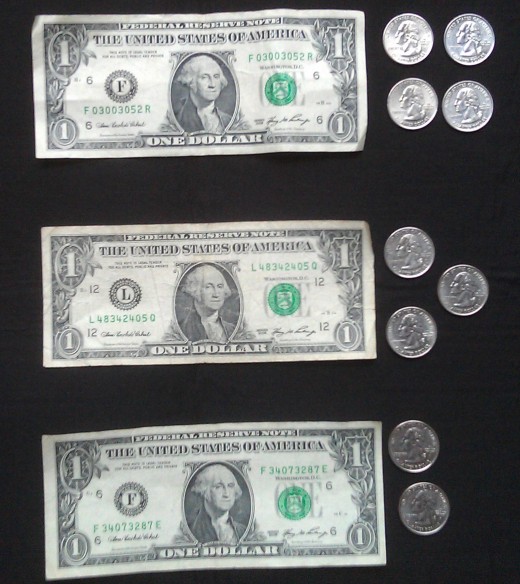

The best way to describe an unbiased appraisal is to look at the asset. The example above illustrates 3 types of sales: 1) the non-distressed sale; 2) the estate or short-sale; and 3) a foreclosure. Assuming that all of the homes are of similar size, construction, structure, condition, and location, they all are worth the same amount. The non-distressed sale is represented by a dollar bill being exchanged for 4 quarters. The estate sale or short-sale is represented by a dollar bill being exchanged for 3 quarters. And lastly, the foreclosure is represented by a dollar bill being exchanged for 2 quarters. In each scenario, the holder of the dollar bill (the home) has a different motivation for the exchange. The non-distressed seller is only willing to exchange the dollar bill for its full worth in quarters, the estate sale or short-sale is willing to exchange the dollar bill for a portion of the full worth in quarters, while the foreclosure is willing to accept far less than the full worth of the dollar bill in exchange for quarters. In each instance, the dollar bill is worth 4 quarters regardless, it is the seller’s motivation that determines what will be accepted in the exchange. The same is true of real estate exchange – regardless of the seller’s motivation, the asset’s value remains the same.

Appraisal

Appraisals are a funny thing. They offer a snapshot of an opined value at a certain point in time. When sales prices were increasing, market value appraisals increased along with them.

Not all appraisals are the same or function with the same purpose in mind. Some appraisals are based on the market value (most often used by lenders in assessing loan limits and sellers when pricing the home for market offering); some appraisals assess ad valorem tax valuations (often “lump” values of all properties in a given area and performed by a state revenue commission); some appraisals assess construction values (often used by insurance companies to value the cost to reconstruct the home); rental value appraisals (often used by investors when purchasing housing for potential income revenue); among other types of appraisals. Each type of appraisal has a particular audience in mind. The tax assessor “looked the other way” when the “market values” of homes were out-of-line with “cost of living” inflation percentages since it also increased their tax revenue base and bloated their coffers. And most insured values do not include the value of the dirt the home sits on since most often the land itself will remain after most commonly insured occurrences (fire, storm, etc.). But, I digress.

Real estate appraisals are typically performed by a licensed appraiser and conform to the Uniform Standards of Professional Appraisal Practice (USPAP).[11] Appraisers are guided not to intentionally deflate the property’s market value based on its sales price.[12] Moreover, appraisers are guided not to conclude market value is equal to the contract price of the home being valued.[13] “Market Value”[14] is accepted by all governmental regulating authorities to mean:

. . . the most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller, each acting prudently, knowledgeably and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

(1) buyer and seller are typically motivated;

(2) both parties are well informed or well advised, and each acting in what he considers his own best interest;

(3) a reasonable time is allowed for exposure in the open market;

(4) payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and

(5) the price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.

Unwarranted Assessment of PMI

This returns the subject to the Federal Reserve’s requirement that PMI automatically terminate when “. . .you acquire 22% equity in your home (based on the original appraised value of the house) as long as your mortgage payments are current.”[15] (Emphasis added).

The Federal Reserve bases termination on 22% equity based on the original appraised value of the home at the time of purchase. Taking the $200,000 foreclosure purchase scenario with a minimum $7,000 down payment for a total loan amount of $193,000 for a home with a true market value of $250,000, no PMI should be assessed in that the property itself provides the security to the lender for which PMI was founded to ensure. Put linearly:

$193,000 (Loan Amount)

÷ $250,000 (Market Value)

= 77.2% (Loan-to-Value) or 22.8% Equity

For whatever reason the purchaser did not put down 20% on the home at the time of purchase (whether from loss of equity from the sale of a previous home due to current market conditions, loss of income due unemployment, or a number of other reasons), the PMI assessment for a purchase under the conditions presented in the scenario above constitute unjustified fees that can potentially cost the borrower in excess of $13,138.50 based on the upfront fee and 5 years of monthly premium payments. It is also interesting to note that the monthly PMI assessment of $186.81 also diminishes borrowing capacity by $42,800.[16] Preferably, the additional $186.81 a month would be saved for retirement instead of purchasing a larger, more expensive home.

The scales are no longer tipped in the lenders favor – however, lenders and mortgage brokers are fighting to tip them back by charging unwarranted, unjustifiable and non-refundable fees. Some brokers are even ordering appraisals requesting the value be based on the property’s distressed value (meaning, requesting that the appraiser further diminish the home’s market value to warrant PMI). Buyers be warned!

Remedy

The terms in which an appraisal is ordered is considered privileged and is held in confidence between the appraiser and the lender. Regardless that the borrower is the ultimate consumer and the party responsible for paying for the appraisal, the borrower is limited to disclosure of only the appraisal itself. If you are purchasing a discounted home and the appraisal comes in for significantly less than the current market value of non-distressed sales in the surrounding area (whereby the lender can claim justification for PMI assessment), first dispute the appraisal with the lender and request the appraiser reexamine the comparable sales. If the appraiser is unwilling to provide a true assessment of the asset, contact the State Appraisal Board to file a complaint and request a peer review of the appraisal. This will at least secure documentation that you did attempt to mitigate your damages – then seek legal representation.

For related topics, please see the author’s other HubPages articles.

___________________________

If you've found this information to be useful, I would appreciate your “like-ing” on Facebook, “Twitter-ing” the link, “+1-ing” on Google, “follow-ing” the writer for spinoff discussions on this topic, and leaving your comments below – most importantly, please click on some advertiser links (as that is what pays for HubPages' website to have provided the forum to distribute this information to you for free). Thank you!

DISCLAIMER: The information on this page is provided by a freelance consumer advocate who has not solicited the opinions of the HubPages directors. HubPages only provides the platform to make this information easily available to users of the internet. The information on this page is the copyrighted intellectual property of Perry Fender and the opinions expressed are solely those of the author.

---------------------------------

[1] http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/buying/glossary

[2] http://www.federalreserve.gov/boarddocs/supmanual/cch/hpa.pdf

[3] http://www.fha.com/fha_requirements_mortgage_insurance.cfm

[4] http://www.alta.org/govt/issues/05/fha-05-03.pdf

[5] http://www.federalreserve.gov/pubs/settlement/default.htm

[6] “Loan to Value” (LTV) Ratio: a percentage calculated by dividing the amount borrowed by the price or appraised value of the home to be purchased; the higher the LTV, the less cash a borrower is required to pay as down payment.”

[7] http://www.federalreserve.gov/boarddocs/supmanual/cch/hpa.pdf

[8] http://www.law.cornell.edu/uscode/usc_sec_12_00004901----000-.html

[9] http://www.frbsf.org/publications/consumer/pmi.html#require

[10] http://www.fha.com/fha_requirements_mortgage_insurance.cfm

[11] http://www.uspap.org/

[12] http://www.uspap.org/FAQ_files/faq101-150/faq_136_.htm

[13] http://www.uspap.org/FAQ_files/faq01_50/faq_18_.htm

[14] http://www.uspap.org/AO/ao21_32/general_commnt_ao22.htm

[15] http://www.federalreserve.gov/pubs/settlement/default.htm

[16] http://www.fhaloancorp.com/calculators/affordability-calculator.php